Discover How Our

"Elite Financial Program"

is Revolutionizing the Way

Business Manage FICA

Expenses

and Employee Benefits

Our exclusive "Section 125" Program offers a

groundbreaking opportunity

for business to significantly reduce FICA expenditures by

$700 to $800 per W2 employee on payroll.

Let us show you how much

you can save!

Are You Ready to Maximize Your Savings and

Empower Your Employees?

Our Program has

the potential to

Revolutionize Your Business!

Use the calculator to see your potential savings

Savings Calculator

Calculate Your Savings.

Estimated Annual Savings: $700

What does our

Elite Financial Program provide?

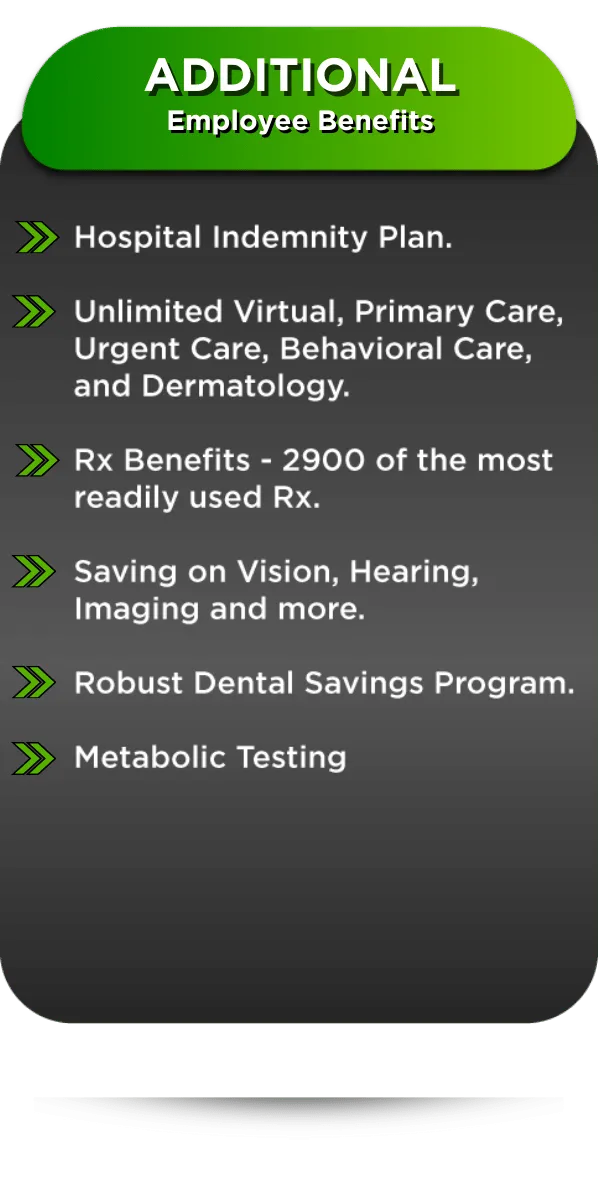

We are a preventative health and disease

management program

that does not disrupt or replace insurance offerings.

Introducing Our

Elite Financial Program

We take charge and emphasize health measures.

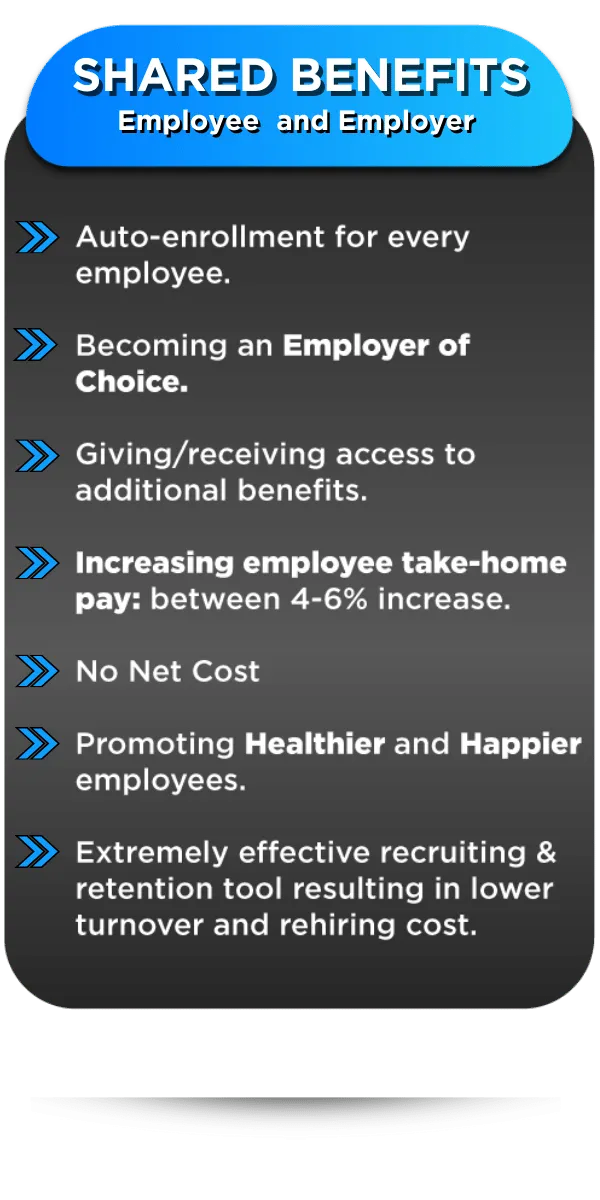

Our program supplements existing major medical plans without disruption.

There are no out-of-pocket costs for employees to enroll and the cost is taken from the savings provided by the Elite Financial Program.

Addressing Recruitment, Retention, and Revenue challenges for employers.

Experience the peace of mind of focusing on proactive health management with the Elite Financial Program.

Introducing Our

Elite Financial Program

We take charge and emphasize health measures.

Our program supplements existing major medical plans without disruption.

There are no out-of-pocket costs for employees to enroll and the cost is taken from the savings provided by the Elite Financial Program.

Addressing Recruitment, Retention, and Revenue challenges for employers.

Experience the peace of mind of focusing on proactive health management with the Elite Financial Program.

A few of the many companies

that have experienced positive

Outcomes

Are you Ready to Maximize

Your Savings and Empower

Your Employees?

Apply Now to explore how our Elite Financial Program

can transform your business.

Don't miss the opportunity to reduce expenses. increase employee pay, and offer unparalleled medical benefits.

FAQs

How does it work?

Employees will see two new line items on their paycheck. The first being the pretax premium which reduces the taxable income of the employee. The second being the indemnity claim payment, for the employee being engaged in this program. The result of the two events is savings for the employer, and a net increase in pay for the employee.

Is this compliant?

This is the only Section 125 program that is both individually approved by the Department of Insurance, and backed by an A+ rated carrier.

How are the tax savings and increase in pay possible?

Obviously we know that the health care system is under tremendous financial pressure. The government is spending around $4.3 trillion on health care each year, and in an attempt to alleviate pressure from the system, congress approved and added very interesting tax code to the affordable care act. This tax code states that if an employee engages in medical care benefits offered within a Section 125 insurance product, they are eligible to receive a claim payment on a monthly basis. Encompassing Health leverages section 125 tax code to create a pre-tax premium, and tax code within the affordable care act to create a claim payment. The result of the pre tax premium and the claim payment is a reduction in taxes for the employer, and an increase in pay for the employee.

What if we already use section 125 tax code?

A lot of businesses leverage section 125 tax code. But using a Section 125 fully insured fixed indemnity insurance product, to get massive FICA tax reductions is different. The only way you could get these type of FICA tax reductions (saving $700 - $800 per employee on payroll annually) is through a specific health insurance product / program. Only .5% of businesses in the country are actually taking advantage of this type of program… and most of them are larger corporations. (McDonalds, Costco, PF Chang’s etc.) I’m attaching a few images below, so you can see what I mean. These companies saving a substantial amount because of our program. Yes, section 125 tax code has been around since 1978, and it’s super broad… this program maximizes that tax code. Encompassing Health leverages specific tax provisions within the “Affordable Care Act” to give your employees a $1k claim payment (monthly), which reduces your FICA spend, and helps your employees get an extra 4% - 6% net increase in pay. Realistically, there are fewer than 15,000 companies in the USA leveraging this type of program right now… so I highly doubt you guys are currently utilizing this. It is worth an appointment to find out.

How do I get started?

Schedule an appointment with me and I will get you set up.